Page: JICA Loan

JICA Loan

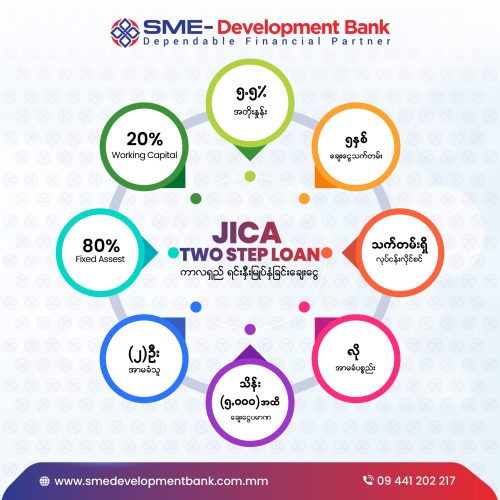

Japanese International Cooperation Agency & SME Bank together cooperating with lending for up to 5 years, this is a type of loan that is cheaper than regular bank interest rates.

Terms:

- Interest rate: (5.5%)

- Loan Term: The loan term is 5 year

- Must use 80% and operating income (20%) to buy fixed assets.

REQUIREMENT DOCUMENTS FOR OPENING ACCOUNT

- (3) License Photo (Within 6 month)

- Copy of National ID

- Household Registration

- A copy of a valid business license

- Actual Living in ward Recommendation and actual operation in Zone Recommendation

- Receipts of revenue tax for the last 3 years

- Financial statements for the last 3 years

- Collateral (land & building)

- (Within 6 months for Grant, map and history of property) (From105/106)

(Remark-Bank Loan to Recommend)

- Insurance Property affidavit

- Documents concerning the ownership of properties

- Business Photo (Front/Back/Left & Right)

- Business Proposal

- BOD meeting minutes to get loan from bank

- Insurance submitted a list of items / values

Recent Posts

- Online Scam Awareness Campaign February 24, 2026

- AGM_2024_2025 December 16, 2025

- MSME Products Thadingyut Festival October 9, 2025

- Stay Safe from Online Scams September 1, 2025

- Central Bank Instruction about NRC July 5, 2025